A Message from the CFO

Targeting sustainable growth through improvements in profitability and effective cash allocation

Keita Suzuki

Director, Representative, Executive Vice President, and CFO

Evaluating progress over the first half of MTP2026

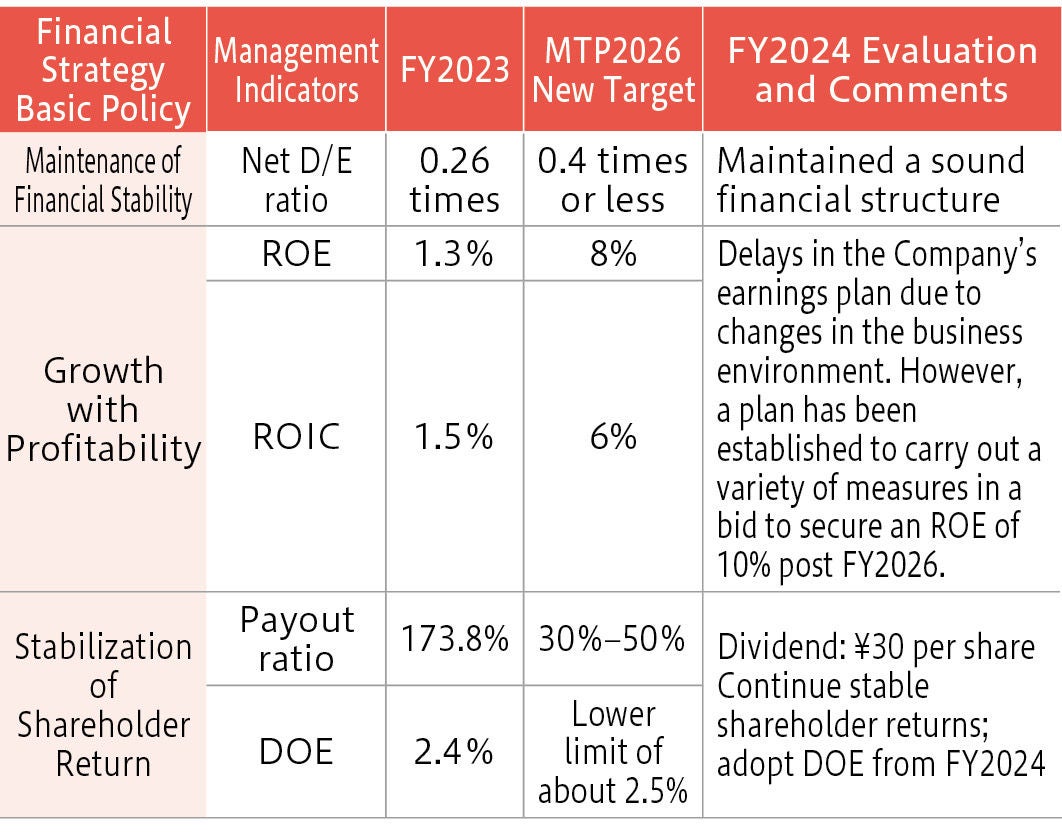

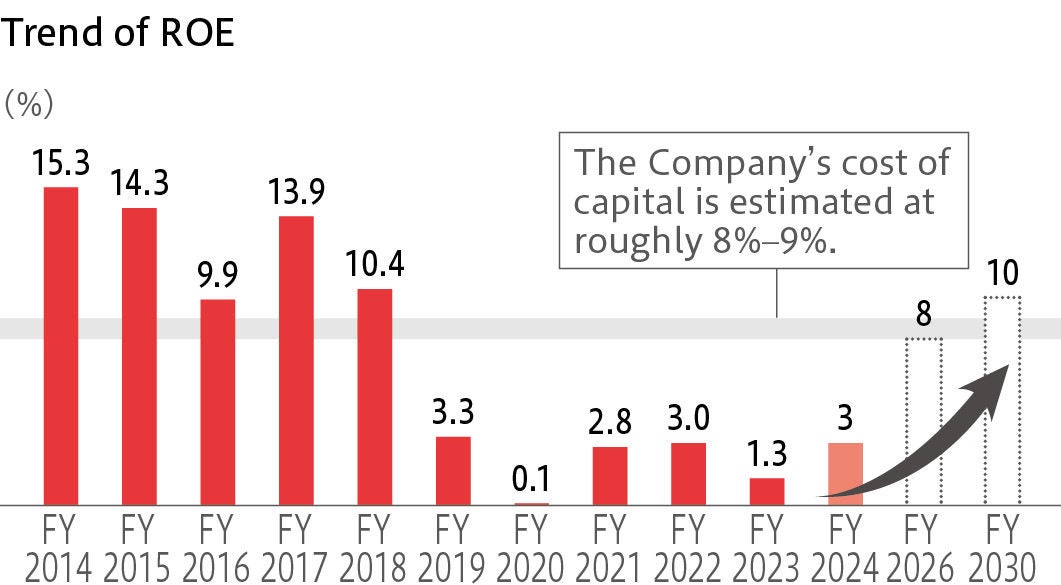

NSK is actively working to achieve its Mid-Term Management Plan, which covers the five years from FY2022 to FY2026. Amid changes in the business environment initially envisioned, financial results in FY2023, the second year of the Plan, were mixed. In specific terms, sales increased 12.1 billion yen compared with the previous fiscal year to 788.9 billion yen. In contrast, operating income decreased 16.4 billion yen year on year to 27.4 billion yen. In addition, NSK’s net income attributable to owners of the parent, the sum of continuing and discontinued operations, came in at 8.5 billion yen, a year-on-year decrease of 53.8% after accounting for such factors as the partial reversal of deferred tax assets in Europe. Taking also into consideration our ROE of 1.3%, we are far from satisfied with these results.

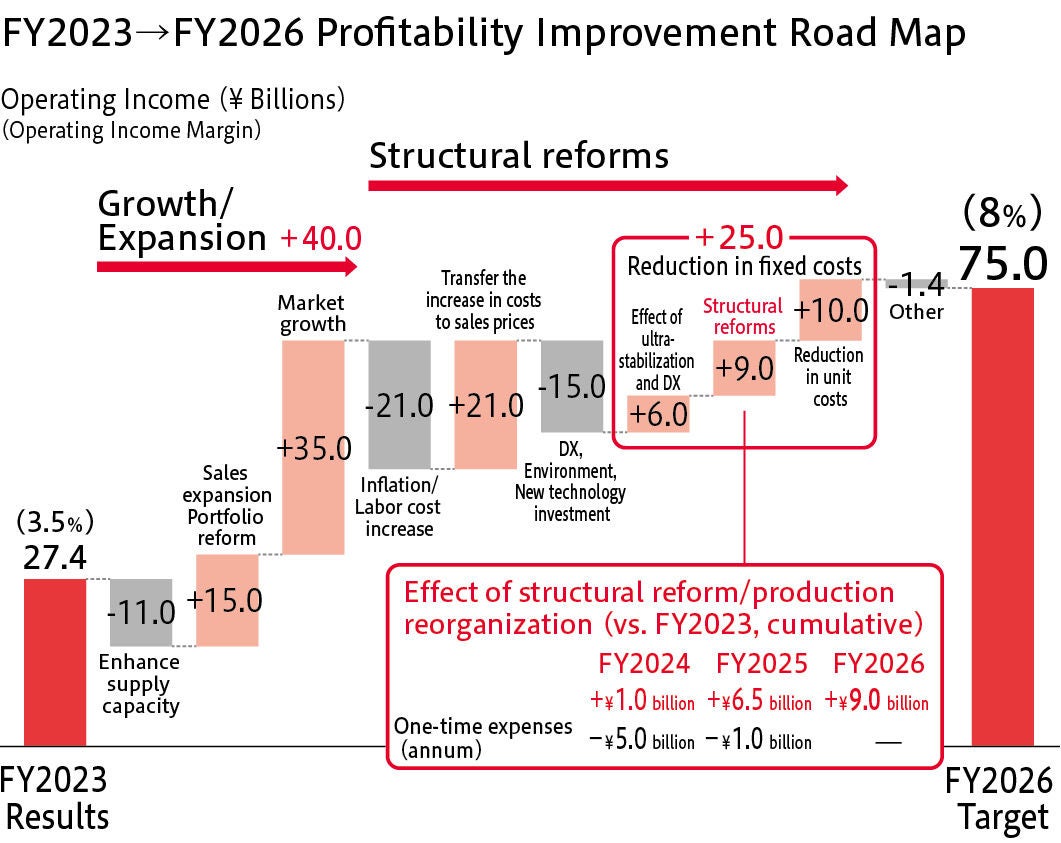

Based on the incidence of delays compared to initially forecast plans owing to changes in the business environment, and the transition of the steering business to a joint venture, we reviewed and disclosed details of revised MTP2026 targets in May 2024. NSK is now targeting sales of 900 billion yen, operating income of 75 billion yen, an operating income margin of 8%, an ROE of 8%, and an ROIC of 6%.

Looking back on progress by business in FY2022, the first year of MTP2026, the Automotive Business initially confronted a harsh operating environment most notably impacted by such factors as daily fluctuations in customers’ production volume plans owing to shortages in semiconductors and other components. Thereafter, in FY2023, these difficult conditions gradually began to dissipate. Despite minor fluctuations in profitability, automobile production volumes grew and financial results trended toward a recovery. Buoyed also by progress in passing on inflation costs to selling prices, successful steps were taken to secure an operating income margin of 5%.

Meanwhile, NSK reported record-high sales in the Industrial Machinery Business in FY2022 on the back of robust demand over the first half. Conversely, the downturn in demand that began from the second half, owing to weak real estate market conditions and the subsequent slowdown in China’s economy, continued into FY2023. Because the marginal profit margin in the Industrial Machinery Business is higher than that of the Automotive Business, the impact of fluctuations in the amounts of raw materials is also greater. NSK’s Industrial Machinery Business precision machinery and parts for machine tools and semiconductor production equipment, products in which the Company is strong, are especially vulnerable. For this reason, we recognize the need to bolster our resilience to the effects of fluctuations.

Promote structural reforms in Europe toward the second half of MTP2026

One key initiative during the second half of the Mid-Term Management Plan is to improve profitability in the European region. Buffeted by a weak economy and deterioration in its product mix, NSK is experiencing difficulties in maintaining profitable operations. Owing to its poor performance, the Company has also failed at times to adequately upgrade its production facilities. As a result, we have witnessed a downturn in profitability due to the decline in productivity attributable to aging plants and equipment. While the acquisition by our small motor E&E segment of a state-owned company and its mainstay plant in Poland has since contributed significantly to NSK’s growth, Poland’s decision to join the EU, rising labor costs, and the sharp surge in energy costs associated with the conflict in Ukraine, coupled with the aforementioned factors, have led to continued difficult conditions and our ongoing inability to boost profits.

Under these circumstances, we undertook a review of our Mid-Term Management Plan. As a part of this review, we took the bold step to reform the structure of our business in Europe. Together with efforts to put in place a more resilient earnings structure, we are working to engage in optimal global production. To this end, we will invest a total of 6 billion yen (5 billion yen in FY2024 and 1 billion yen in FY2025) in structural reforms, mainly in Europe, which we project will help improve profitability by 9 billion yen per year in FY2026 compared with FY2023. Recognizing the critical role this initiative will also play in improving ROE, we will pull out all the stops to bring these investments to fruition.

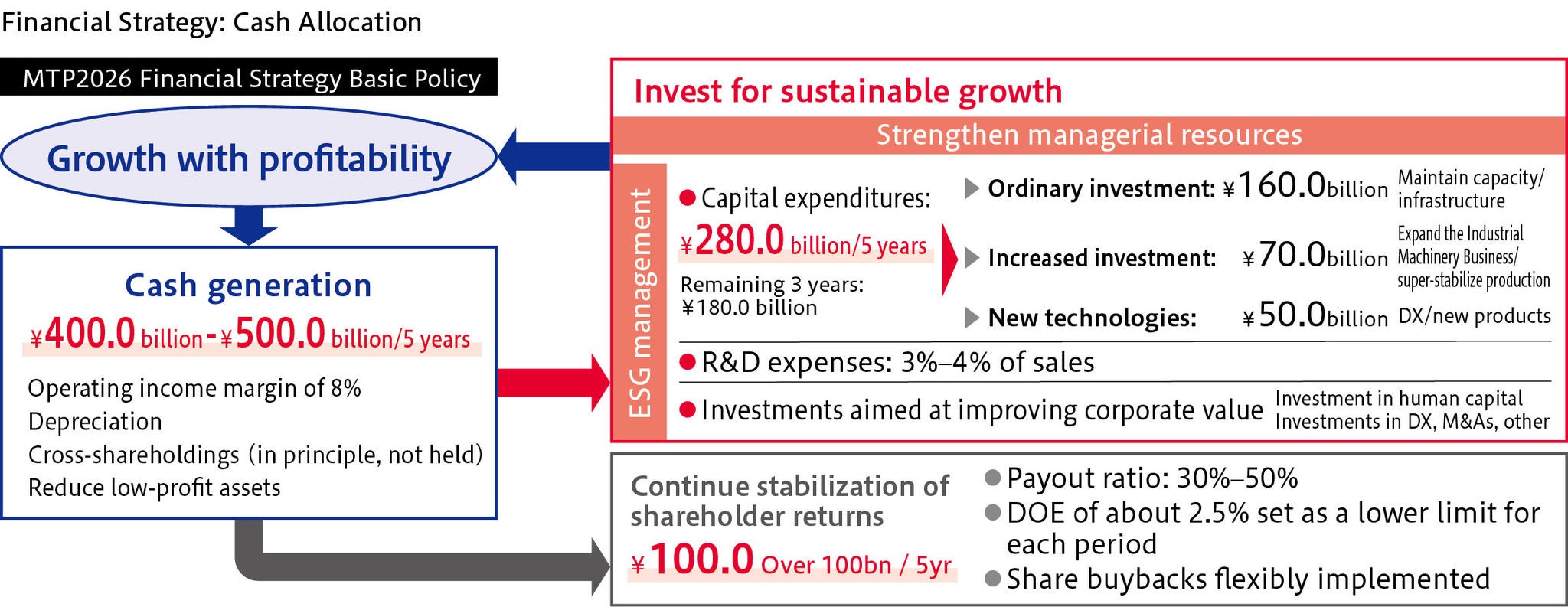

MTP2026 basic policy on the allocation of cash

We are confident in our ability to generate between 400 billion yen to 500 billion yen in cash over the five years of MTP2026 through various means, including operating cash flows and the reduction of cross-shareholdings. Of this total, we will allocate 280 billion yen to measures aimed at securing sustainable growth. Working diligently to realize the Group’s concept of Bearings & Beyond, we will not only engage in recurring investments that include the maintenance of facility capacity but also allocate cash to help expand the Industrial Machinery Business as a part of our portfolio reform endeavors, as well as such investments as DX and the development of new products.

As far as shareholder returns are concerned, we have set a dividend payout ratio of between 30% to 50% and 2.5% as a lower limit for DOE as indicators. By reflecting upside in the dividend payout ratio and indicating stable dividends through DOE, we are projecting shareholder returns of at least 100 billion yen over five years. Moreover, we are considering a variety of measures, including M&As, as a part of efforts to improve our corporate value.

From a share buyback perspective, NSK acquired 25 million of its own common shares at an acquisition cost of 21.7 billion yen and cancelled 51.27 million of treasury shares in FY2023. Timing and conditions are key factors in the acquisition of treasury shares. Accordingly, we will undertake the buyback of shares in an appropriate and flexible manner based on a variety of factors.

Turning to another key component in securing sustainable corporate growth, we recognize the critical need to invest in various measures aimed at addressing ESG concerns. With this in mind, I believe that we must put in place a cycle through which we allocate the earnings generated by our business activities to measures designed to resolve social issues. For example, in a bid to help resolve environmental issues, our goal is to become carbon neutral by minimizing the environmental impact of our business activities at the “creation” stage and maximizing the environmental contribution of our products at the “utilization” stage. I am convinced that in establishing this cycle, we will be better placed to mitigate ESG risks, which in turn will lead to a reduction in the cost of capital.

NSK must better align its structure and systems to anticipated changes in its operating environment. Our personnel system is an issue of particular note. Here, we have introduced a role-based system for managerial positions. Human resources are critical to improving corporate value. With this in mind, we will continue to invest broadly in human capital, including development and training.

Approach to maintaining financial stability and financial leverage

Maintaining our financial stability is essential to both ensuring our sustainable growth and our ability to withstand changes in our business environment. Against this backdrop, the Group’s equity ratio, net D/E ratio, liquidity on hand, and other indicators that measure its financial stability and health remain sound.

NSK has set a net D/E ratio target of below 0.4 times under MTP2026. Even as the need to allocate cash for such investments as M&As arise, we will engage in the flexible and effective use of interest-bearing debt after securing a stable financial base.

Reduction of cross-shareholdings

In reviewing our Mid-Term Management Plan, we reiterated our stance to refrain from holding cross-shareholdings as a general rule. We also recognize the critical need to use the cash generated through the sale of cross-shareholdings to help secure growth with profitability, increase earnings capacity, and enhance our corporate value. While coming in at 15.1% as of the end of FY2022, NSK’s proportion of cross-shareholdings to total consolidated capital fell to 5.5% as of the end of FY2023, and deemed holdings of equity securities held for purposes other than pure investment were reduced to zero. In April 2023, we were able to return part of the cash from the reduction of deemed holdings in FY2022 to the company.

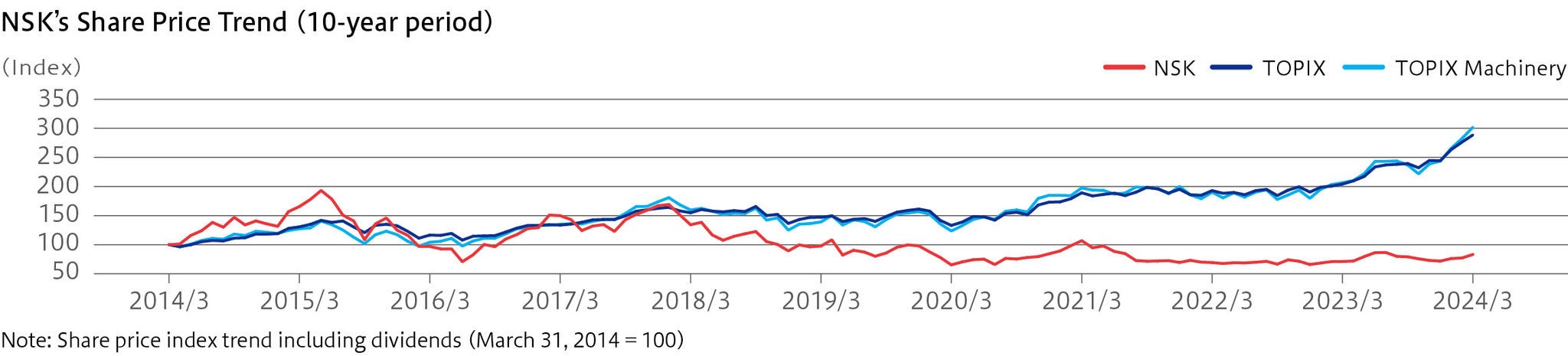

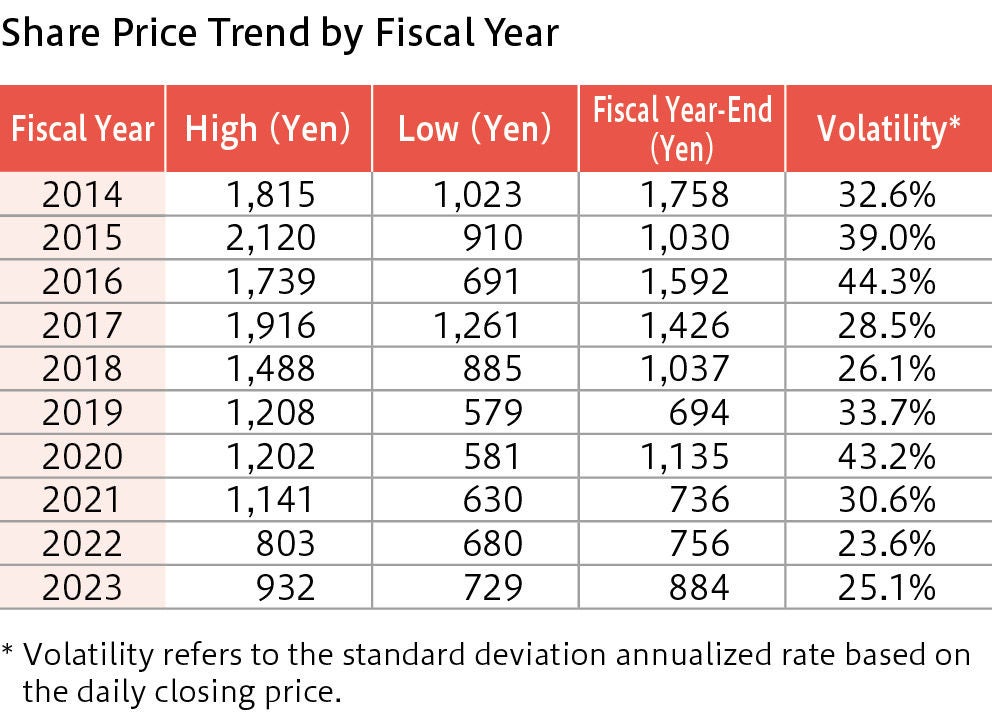

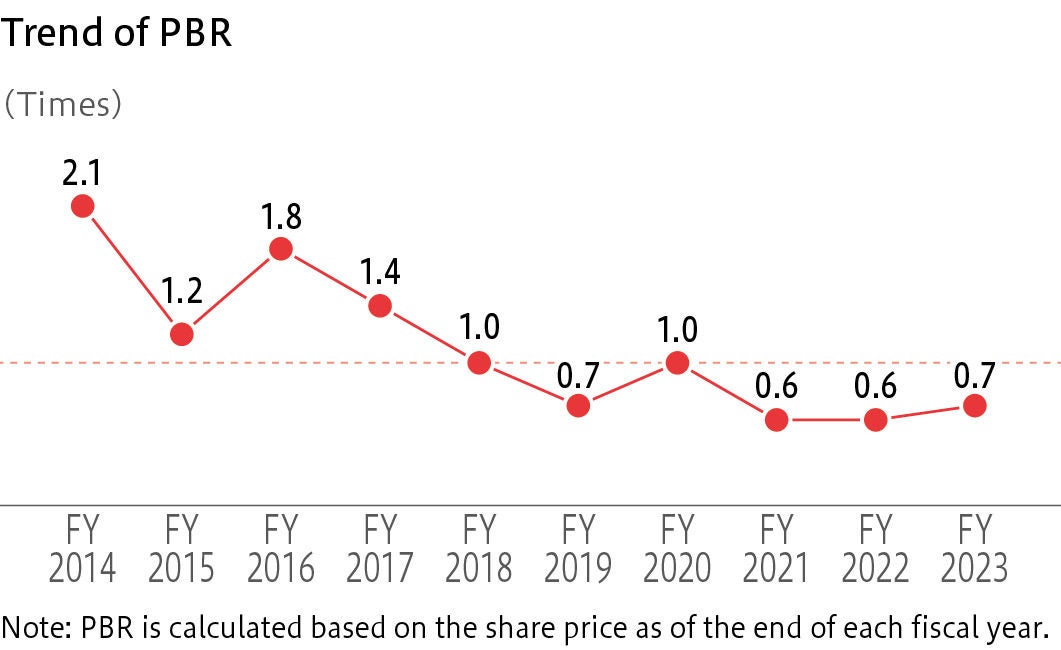

Evaluation of NSK’s share price and PBR

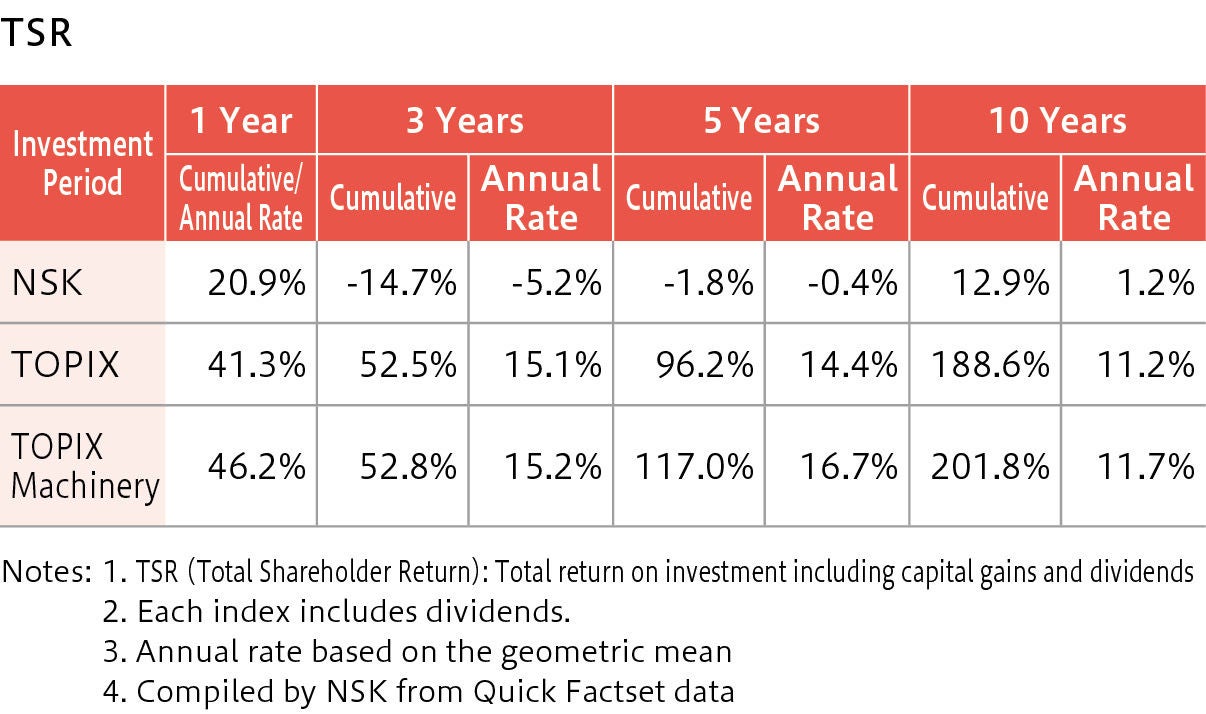

Continuing to underperform the TOPIX and TOPIX Machinery indices, NSK recognizes that the inability of its share price to break out of the 700 yen to 900 yen range, representing a PBR below 1, is a top management issue.

We are acutely aware of the need to secure an ROE that exceeds the cost of capital (an ROE of roughly 8%–9%) if we are to address this issue. To this end, it is vital that we first put in place an earnings structure that reflects the new financial targets set under MTP2026, namely sales of 900 billion yen, operating income of 75 billion yen, and an operating income margin of 8%. Looking at the Group’s growth and expansion endeavors identified in its profitability improvement road map to FY2026, we will work diligently to expand sales of high-profit products, improve our business portfolio, and seize opportunities for growth in burgeoning markets. As a part of our structural reform initiatives, and in addition to engaging in ultra-stable production and increasing efficiency through DX, we will reap the benefits of measures aimed at reorganizing production, including efforts to reform the structure of our European operations. At the same time, we will push forward a raft of effective measures, including the reduction of cross-shareholdings while providing appropriate shareholder returns. By improving the efficiency of our assets, our goal is to lift ROE to 8% in FY2026 and 10% in FY2026.

(October, 2024)