Compañía - 21/08/2023

NSK forms 49.9:50.1% joint venture for its steering business

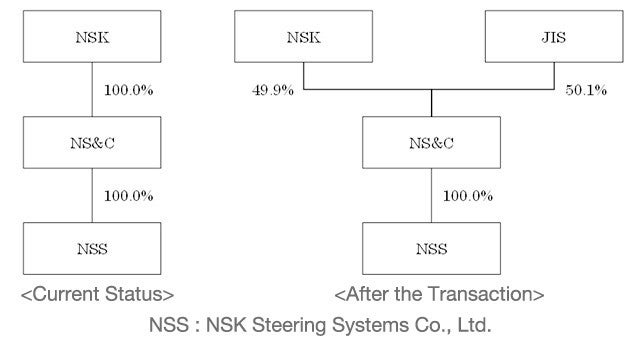

In May 2023, NSK Ltd executed a joint venture agreement (JVA) with Japan Industrial Solutions III Investment Limited Partnership (JIS) that set out three primary actions. NSK Steering & Control Inc (NS&C), a consolidated subsidiary which controls NSK's global steering business, would firstly issue class shares to JIS equivalent to 50.1% of NS&C voting rights via third-party allotment. Furthermore, JIS and NSK would operate NS&C jointly, and thirdly, NS&C would pay a special dividend to NSK prior to the third-party allotment.

On 31 July 2023, NSK resolved to change the third-party allotment so that NS&C would temporarily issue all 10,041 class shares to NSK, after which NSK would transfer all 10,041 class shares to JIS for ¥20 billion. As a point of note, NSK also resolved to complete the transaction (share issuance and payment of special dividend) in a way that was partially different from the previously disclosed information.

In accordance with the original JVA, NSK planned to have NS&C issue 10,041 class shares directly to JIS, the equivalent to 50.1% of NS&C voting rights, by way of third-party allotment. However, after discussion with JIS, NSK concluded (with JIS consent) to change the third-party allotment to the transfer. The shareholding and voting rights remain the same regardless of the change.

A previous NSK news release, dated 12 May 2023, provides an outline of the relevant subsidiary/specified subsidiary (sub-subsidiary), as well as an overview of the class share underwriters. The same text also outlines the status of NS&C and NSS shares and voting rights held by NSK before and after the transaction.

As a result of the transfer, NS&C and its consolidated subsidiaries became an equity method affiliate of the company on 1 August 2023, and are now excluded from NSK’s scope of consolidation. Subsequently, effective from the first quarter of the current fiscal year, the steering business is classified as a discontinued operation. The NSK Group will therefore present its consolidated sales, operating income and income before tax excluding the discontinued operations, while presenting income attributable to owners of the parent company and basic earnings per share as the sum of continuing operations and discontinued operations.

As for the impact on the company's full-year consolidated performance for the fiscal year ending 31 March 2024, sales are expected to decrease by ¥182 billion, and operating income and income before tax are expected to increase by ¥2.5 billion, respectively. Further details are available here. The revision relies on information currently available and only reflects the impact of the steering business classification as a discontinued operation. The company will continue to analyse the impact of this transaction on its business results and promptly disclose any relevant matters.

Diagram showing status before and after the transaction

Compartir